General FAQ

PALN (Penyaluran Amanat Luar Negeri) or Foreign Futures Market are products tradable in foreign exchanges that are transactable in Phillip Futures.

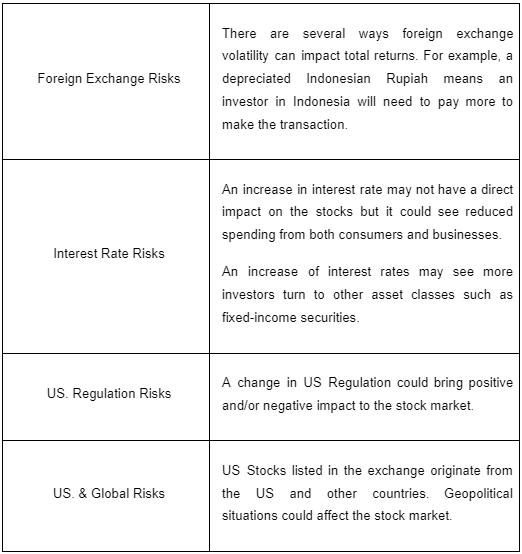

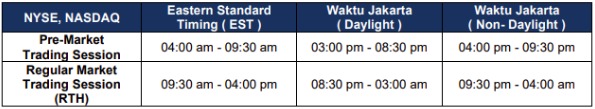

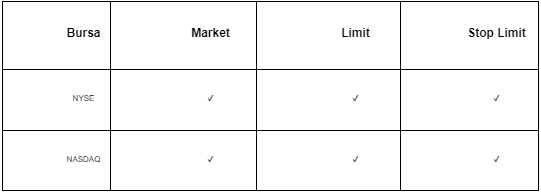

US Stocks is a security that provides equity ownership of the issuing corporation. US Stocks are listed and transacted on US stock exchanges such as New York Stock Exchange (NYSE) and Nasdaq Stock Market (NASDAQ).

US Stocks are tradable in Phillip Futures, for more information please click here.

We offer products in these categories:

- Stock Index: FTSE Indonesia Index Futures, Micro E-mini US Index and FTSE China A50 Index

- Commodities: Energy, Metals and Agriculture

- Currency: AUD, GBP, CAD, INR, YEN, CHF, EUR, NZD, MXN, E-mini Yen, E-mini EUR, E-micro AUD, E-micro GBP, E-micro INR, E-mini EUR

- US Stocks : NYSE & NASDAQ

Platform Nova is used to trade PALN & US Stocks. Click here to learn more about platform Nova 2.0.

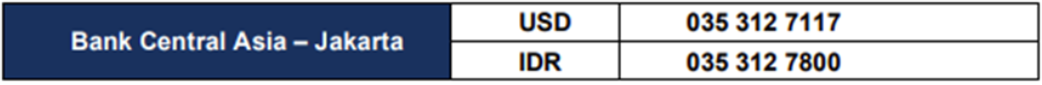

Clients are able to deposit funds into our segregated account under Phillip Futures. Clients are obligated to input their account numbers on the remarks column when doing deposits.

Clients are able to do deposits to their trading accounts on weekdays from 09.00 – 18.00 WIB.

Please contact our Client Service team at (021) 5790 6525 or email futures@phillip.co.id if you need help logging into the Client Portal.

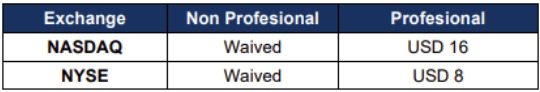

During this promotion period, you do not need to pay platform fees for your account. This will help you maximise your trading returns with us.

This promotion can be altered at any time, and all decisions of PT Phillip Futures regarding this promotion cannot be contested.

During this promotion period, you will not be charged inactivity fees for the account

This promotion can be altered at any time, and all decisions of PT Phillip Futures regarding this promotion cannot be contested.

You can cancel your working order and input a new order with the volume or price that you desire.

Phillip Futures offers a free coaching session for Clients to learn trading and/or investing. Click here to make an appointment.